What is Search Arbitrage?

For those unfamiliar with search arbitrage, please refer to our previous article. Search arbitrage is a traffic arbitrage method involving purchasing traffic from social media/native/display/search ads and selling search ad results to profit from the difference.

Read the full article on search arbitrage:

Understanding Search Arbitrage

Demystifying Google’s Search Monetization Products

2.1 Legacy AdSense for Search (AFS)

Introduction: Google’s earliest search monetization product allowing publishers to display Google search ads on their site’s search results pages and earn revenue share.

Features:

Early Google search partnership model (Desktop-focused)

Simple monetization with limited functionality

Now replaced by AFS for Partners

2.2 AFS for Partners (AFSP)

Introduction: Upgraded AFS for large-scale search partners with flexible ad integration.

Features:

API-driven deep integration

Richer ad formats and UX optimization

Higher revenue share than legacy AFS

Effective on Desktop & Mobile (better Desktop revenue)

2.3 Online AFS Agreement Mobile

Introduction: Mobile-optimized AFS for apps/mobile sites.

Features:

Mobile-first ad formats

Compliant with mobile ad policies

Supports mobile web/app scenarios

Used by most RSoC providers (works on Desktop/Mobile)

2.4 AFD (AdSense for Domains)

Introduction: Monetizes parked domains via search ads.

Features:

For direct navigation/paid referral traffic

Displays relevant Google ads

Closed to new users since 2013 (limited partners remain)

2.5 GHS (Google Hosted Search)

Introduction: Google-hosted search solution (Custom Search Engine).

Features:

Provides site search + ad monetization

Google-hosted results (no self-built engine required)

Monetization similar to AFS

2.6 AFS Type-in / GHS Type-in

Introduction: Monetizes direct navigation traffic (users typing keywords into browsers/ISPs).

Features:

High-converting traffic

For browser partners/large traffic suppliers

This article focuses on AFS RSoC Feed relating to AFSP and Online AFS Mobile.

The Transition: AFD vs. RSoC

Google’s Policy Shifts on Parked Domains:

Oct 2024: New Google Ads accounts block parked domain ads by default.

Mar 2025: Existing accounts block parked domains unless manually opted-in.

Monthly budget removal for parked domains implemented post-March 2025.

Industry Impact:

AFD expected to phase out by end-2024 with declining RPC.

RSoC emerges as primary alternative.

Key Questions:

How many advertisers will manually opt-in?

How long will Google’s policy transition last?

Google’s Motivation:

Enhance transparency, traffic quality, UX, and advertiser trust.

Understanding Google RSoC Feed

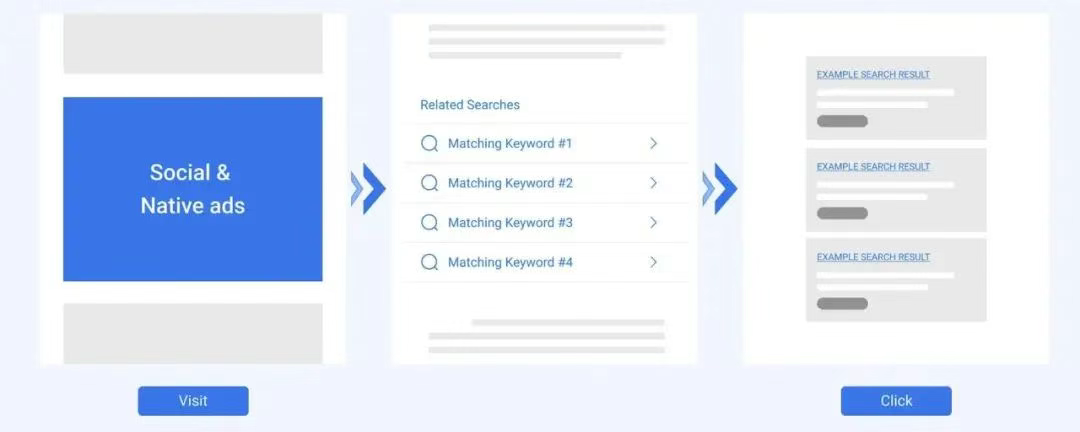

4.1 Workflow

Social/Native/Display Ad → Content Page w/ Related Search Keywords → SERP → Advertiser Offer

4.2 AFS vs. RSoC

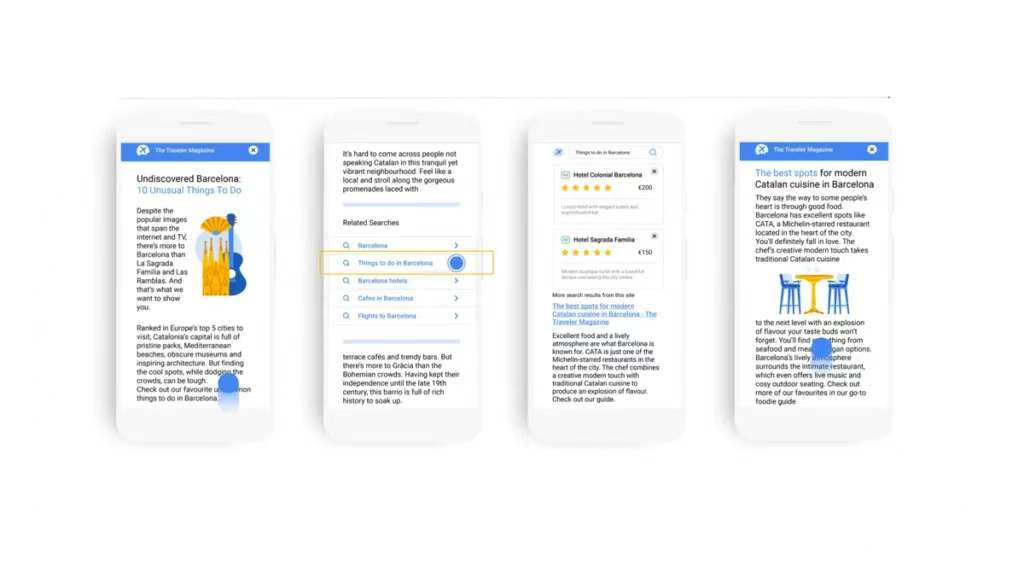

RSoC embeds contextual keywords in content pages to:

Generate search intent from content browsing

Create incremental search queries

Diversify Google's search ecosystem

4.3 RSoC Advantages

Enhanced UX: Value-driven content engagement

Higher RPC: Contextually relevant ads

Diversified Revenue: Supports AdSense + affiliate offers

Sustainability: Aligns with Google's quality guidelines

4.4 RSoC Challenges

Limited Attribution:

No click-level revenue data

Revenue reported only by geo/device/channel

Channel name restrictions complicate tracking

(Solutions: ClickFlare API for estimated attribution)

Keyword Override:

Google frequently overrides preselected keywords

(Mitigation: Use 5+ long-tail keywords + content relevance)

RSoC Feed Providers

5.1 Established Providers

System1 (US): system1.com

ExplorAds (Israel): explorads.media

Inuvo (US): inuvo.com

AirFind (US): airfind.com

Intango (Israel): intango.com

5.2 Former AFD Providers (Transitioning to RSoC)

Sedo (Germany): Apply Here

Tonic (Germany): tonic.com

DomainActive (US): domainactive.com

Ads.com (US): Apply Here

5.3 Emerging Providers

BeesAds | Pubplus | AdMedia

Maximizer Rocket | Predicto

5.4 Via GCPP Partners

Affinity: affinity.com

InMobi: inmobi.com

5.5 In-House AFS Application

Requirements:

6+ months of AdSense history

Policy-compliant content

Valid search integration use case

Revenue Share: 51% of Google-recognized revenue

Payment Threshold: $100 (NET-30/45/60)

Traffic & Compliance

7.1 Approved Traffic Sources

Facebook, TikTok (non-Pangle), Google Display

(Sedo/Ads.com also allow: Taboola, Outbrain, Twitter, Snapchat, Baidu MediaGo, NewsBreak)

7.2 Traffic Quality Metrics

Spam Rate: Keep <15% (≥20% = "moderately unhealthy")

IVT (Invalid Traffic): Causes account suspensions

9.1 Core Principles

Transparency: Ad → Landing Page → SERP journey must be clear

Content Consistency: Pages must deliver ad promises

9.2 Ad Creative Restrictions

❌ Banned: Price/discount claims, medical cures, "free" offers, urgency tactics

✅ Use: Neutral language ("Learn More"), consistent visuals

9.3 Landing Page Rules

Maintain 60/40 content-to-keyword block ratio

Show clear domain branding, no misleading CTAs

Avoid "Read More" buttons, sticky ads, or blended ad/content

9.4 CTA Guidelines

✅ Permitted: "Explore More," "See Options"

❌ Banned: "Apply Now," "Shop Now," "Limited Deals"

9.5 Strict Prohibitions

Misleading offers ("Free car insurance")

Clickbait headlines

Adult/illegal content, trademark abuse

Best Practices

Content Format: Use "Guide to…"/"How to…" articles

First Paragraph: Concise keyword-rich introduction

Keyword Block:

Place prominently (top/sidebar)

Include 5-8 long-tail keywords

Wait 30-60 mins post-publishing for Google indexing

Reporting Note: Data appears only for dimensions with ≥10 clicks

The Future: Survival of the Fittest

Why RSoC Matters:

Aligns with Google’s quality-first approach

Outperforms AFD in UX and RPC

Enables sustainable monetization

Industry Outlook:

Low-quality arbitrage (clickbait/spam) is being eliminated

AI-driven optimization becomes critical

Hybrid strategies (AFD + RSoC) maximize current opportunities

Final Note:

AFD remains viable until its "last click," while RSoC adoption is inevitable. Adaptation and compliance are keys to longevity in search arbitrage.